How a Financial Audit Can Help You Prepare for 2022

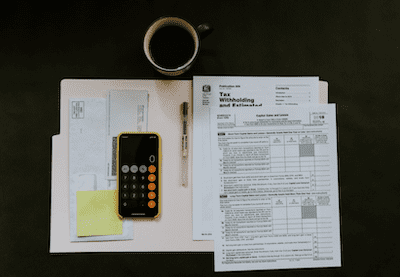

With the end of the year quickly approaching, it's time for your business to start planning for 2022. Hiring a CPA for auditing services is an ideal place to begin. A professionally prepared financial audit will look at everything from how much cash your company...

Continue Reading