One of the most essential elements of financial management in small businesses is expense tracking. As the linchpin in the success of small businesses...

Latest News:

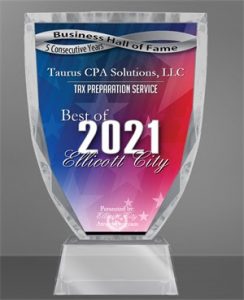

Taurus CPA Solutions, LLC Receives 2021 Best of Ellicott City Award

IRS audits can strike dread into the hearts of even the most diligent and fearless taxpayer, but understanding and preparing for an IRS audit can make...

One of the most crucial aspects of financial management for small businesses is business taxes and understanding the intricacies involved is vital for...

When you own a small business, you’re often forced to wear many hats, with finances being one of them. Navigating the financial complexities of runn...

Any organization that has employees must have payroll, and good payroll management is a must as it allows the company to ensure that they’re accurat...

Starting a business is an exciting journey, but it’s not without its challenges, especially when it comes to managing finances. Bookkeeping, the...

Starting a small business is an exciting time full of new opportunities, but no matter how successful your business is, it will still be vulnerable to...

The words ‘financial audit’ are enough to make anyone’s heart race and send shivers down the spines of business owners and financial managers. W...

In today’s tech-oriented world, taking care of your business finances has never been simpler, thanks to software like QuickBooks. This valuable ...

Meticulous and effective accounting is the backbone of any business and is the one aspect that remains constant in the ever-evolving business landscap...